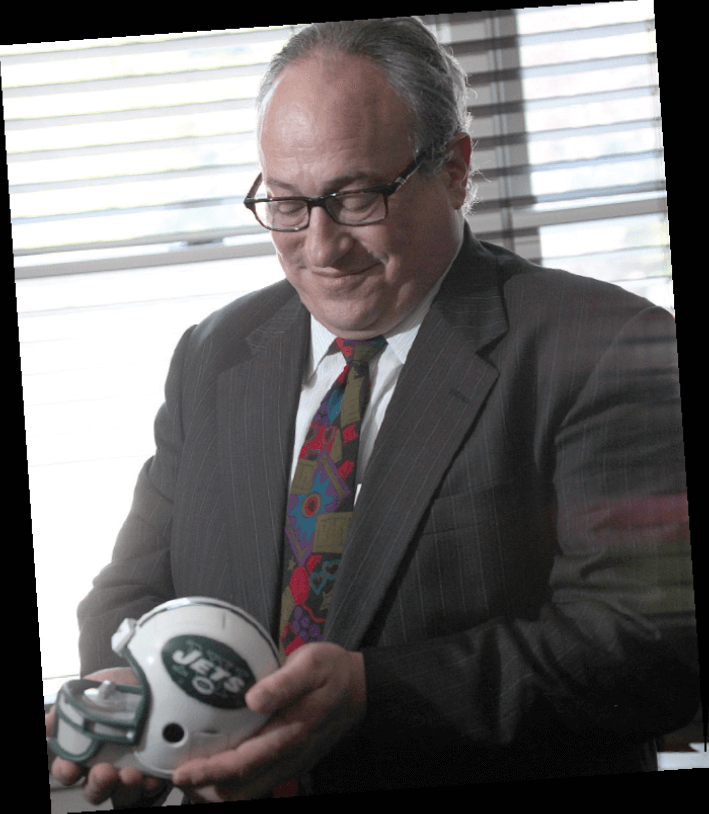

For the sixteenth consecutive year, Stephen J. Silverberg has been named to the New York Metro Super Lawyers list as one of the top New York metro area lawyers for 2022. Each year, the research team at Super Lawyers selects only five percent of the lawyers in the state to receive this honor. Super Lawyers has named Silverberg to its select list of attorneys for sixteen consecutive years, from 2007 to 2022.

Stephen J. Silverberg is recognized nationally as a leader in estate planning, estate administration, asset preservation planning, and Elder Law. He is a past President of the National Academy of Elder Law Attorneys (NAELA), an organization of almost five thousand Elder Law attorneys throughout the country. He was named a NAELA Fellow, the highest honor bestowed by NAELA to “attorneys… whose careers concentrate on Elder Law, and who have distinguished themselves both by making exceptional contributions to meeting the needs of older Americans and by demonstrating a commitment to the Academy.” Mr. Silverberg was a founding member of the New York State chapter of NAELA and served as President of the chapter.

He is a Certified Elder Law Attorney (CELA), designated by the National Elder Law Foundation under the auspices of the American Bar Association. To obtain this designation, an applicant must pass a full-day written examination and is subject to rigorous blind peer review. Since 1993, fewer than 525 Elder Law attorneys in the United States have earned the designation. Martindale-Hubbell has rated Mr. Silverberg AV Preeminent (5.0 out of 5.0), the highest possible designation.

Scott B. Silverberg, for the third consecutive year, was named to the 2022 New York Metro Rising Stars list. To qualify, New York Metro Rising Stars must be younger than 40 or have been practicing for less than ten years. Each year, the research team at Super Lawyers designates no more than 2.5 percent of the lawyers in the state to receive this honor.

He is a member of the National Board of Directors of the National Academy of Elder Law Attorneys (NAELA) and the Board of Directors and Treasurer of the New York State Chapter of NAELA. Scott is Vice-Chair of the Practice Management Committee of the Elder Law and Special Needs Section Executive Committee of the New York State Bar Association. In 2022, he became a member of the Estate Planning Council of Nassau County, a member chapter of the National Association of Estate Planners and Councils (NAEPC). He is also a member of the Nassau County Bar Association.

Scott has attained the LL.M. (Master of Laws) in Elder Law from Stetson University School of Law. This rigorous program is offered only to Elder Law practitioners who have provided legal services in Elder Law matters in complex areas of the law. Stetson’s L.L.M. Elder Law program faculty comprises many leading attorneys in Elder Law.

Super Lawyers, part of Thomson Reuters, is a rating service of outstanding lawyers from over 70 practice areas who have attained substantial peer recognition and professional achievement. A patented multiphase process includes a statewide survey of lawyers, an independent research evaluation of candidates and peer reviews by practice area to create the list. The result is a credible, comprehensive, and diverse listing of exceptional attorneys. The Super Lawyers lists are published nationwide in Super Lawyers Magazines and leading city and regional magazines and newspapers across the country. Super Lawyers Magazines also feature editorial profiles of attorneys who embody excellence in the practice of law. For more information about Super Lawyers, visit SuperLawyers.com.

The Law Office of Stephen J. Silverberg, PC, represents clients in estate and tax planning, estate administration, asset preservation planning, and Elder Law and related issues. The Law Office of Stephen J. Silverberg, PC is at 185 Roslyn Road, Roslyn Heights, NY 11577, 516-307-1236, and online at www.sjslawpc.com.