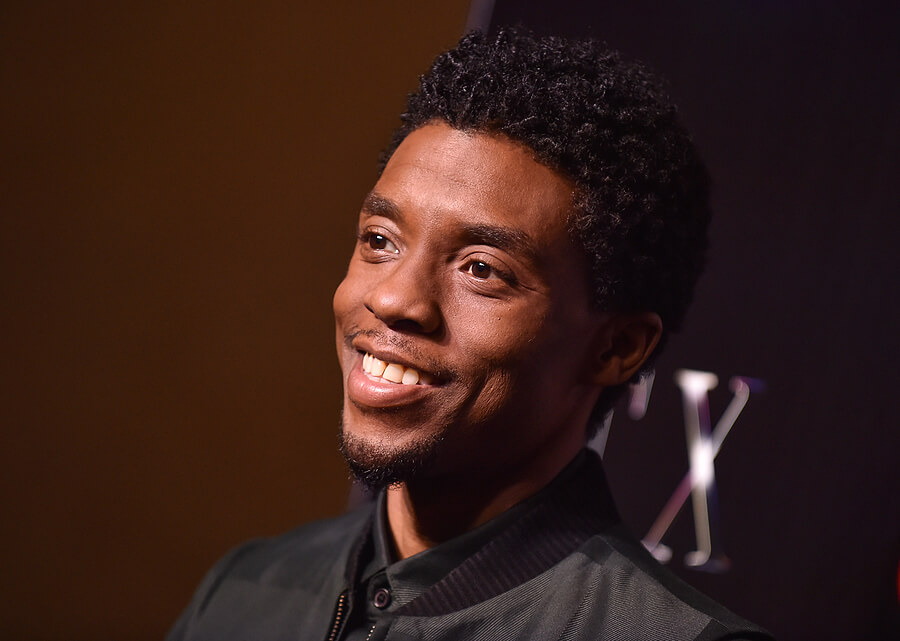

Chadwick Boseman, the actor known for performances in “Black Panther” and “Ma Rainey’s Black Bottom” was only 43 when he died. Despite knowing he was seriously ill from colon cancer, he did not have a will, so Boseman’s family was tasked with managing his estate in a public manner, the direct opposite of how he lived his life.

The estate had significant expenses and it wasn’t too hard for reporters to find the details because there was no will. Court documents obtained by several news sources reveal the estate was initially valued at $3.8 million before taxes, court fees and funeral expenses. The final amount to be divided between his widow and is parents is $2.5 million.

In October 2020, his widow Taylor Simone Ledward petitioned the court to make her an administrator with limited authority of his estate, and then filed a probate case in Los Angeles.

Chadwick did not have an estate plan with trusts that could have provided the family with privacy, reporters and others were able to access court papers to learn details like the exact amount and breakdown spent on his funeral, moneys used to purchase burial spaces for other family members and the court’s determination on several private matters.

You don’t have to be a celebrity for details of your life to be made public. All probate and administration proceedings are public records, and copies of these documents can be obtained by anyone who shows up at the court. Creditors, family members and anyone who wants to pry into the details of your life can obtain these documents. Having an estate plan with the methods and tools best suited for your estate can keep your life private and minimize estate expenses.

But another lesson from the passing of Chadwick Boseman is that families do have the ability—even celebrity families—to treat each other with kindness and respect. His widow asked the court to divide his estate evenly between herself and Boseman’s parents. Most families facing an estate without a will end up in court, battling for an inheritance. Sadly, this is the exception and not the rule with estates. Having an estate plan can prevent the likelihood of your family facing this situation.